Value Added Services Report 2013-2014

Prepare your organisation for the future with 'Beyond the Pill' services

It's Time to Go on the Payer Journey

Pharma is still not speaking the language of payers, despite attempts to engage them with "innovation" and value-added services, discovers Nick de Cent.

Despite the unprecedented importance of market access to the success of a particular drug, pharma companies are “not very good” at developing the payer journey, according to Omar Ali, Formulary Development Pharmacist for NHS England in the Surrey and Sussex Healthcare NHS Trust. We spoke to him ahead of his presentation at the Value Added Services Conference.

A member of the ERG Cost Modeling Panel for NICE (National Institute for Health and Care Excellence), Ali suggests that pharma companies need to engage payers throughout the development process of their offerings. Payers are not getting involved early enough in the commercial aspects of a product.

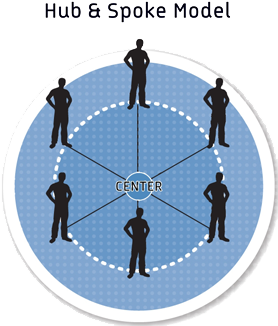

Hub and spoke model

Currently pharma doesn’t have a way to establish engagement with payers at national level which also results in traction at a regional level, that is, with a KAM team via the CCGs".

In response, he has developed a “payer hub and spoke model” designed to act as a roadmap for pharma companies seeking to gain market access for their products, so that they gain greater understanding and traction within the market.

“Currently pharma doesn’t have a way to establish engagement with payers at national level which also results in traction at a regional level, that is, with a KAM team via the CCGs (Clinical Commissioning Groups),” he explains. In terms of payer engagement, some pharma companies may be successful either at national or regional level, while others do neither, but none tends to be good at both.

The new model seeks to “build the payer journey” by creating a national payer network, with a "hub & spoke" linking to key account managers. This starts and spreads from a national forum that becomes integrated regionally. It aims to encompass the whole lifecycle of a brand from pre-launch, through launch and beyond, incorporating data that goes further than a simple “budget impact model".

His suggested step-by-step process mirrors the approach that pharma already adopts for Key Opinion Leaders. The concept seeks to take a strategic approach nationally that dovetails with regional and local market access teams. Currently KAMs are finding it tough going, with perhaps as few as 2-4 good payer calls a month. Ali explains: “When you look at those contacts they’re not particularly great: they’re not very high quality and lacking in substance and depth". The result, he says, is that both parties – the payers and the pharma side – come out frustrated.

New relationship

Partly this is because of a lack of understanding of what payers are expecting from their interactions with pharma companies, but it may also be the consequence of a sales approach that doesn’t embrace true KAM principles, whereby sales reps have simply been rebadged for a new commercial role. “When they struggle, they tend to revert to type,” Ali suggests.

They don’t want a sales relationship; they want a business discussion"

As a consequence, payers are looking for a wholly different relationship at every level, Ali claims. “They don’t want a sales relationship; they want a business discussion". This should be centered on an evidence-based relationship that provides value. “There’s learning to do on both sides", he acknowledges, however.

The three dimensions of engagement

Ali sees three dimensions to the issue of engagement: the content of the message, the way the message is delivered and the geographical basis by which pharma organizations pursue engagement. “Companies often have quite a good market access team but there is no payer message or it doesn’t resonate with us.” Simplistic messaging is often a problem, particularly with larger pharma organizations that may be keen to pursue economies of scale with simplified “one-size-fits-all messaging” across many planes. In terms of message delivery, the caliber of the KAM team is “still wanting”, he adds. Finally, pharma companies’ organizational structures often don’t mesh with those of the client

One cause may be that market access as a discipline is still relatively new (less than 10 years old) and hence is yet to develop a power base within pharmaorganizations, where it can be seen as a function with little budget that frequently shifts where it sits within a firm. “Market access may have become a ‘tick box’, somewhat neutered animal", Ali declares.

Adding real value

Value added services are important in the context of the payer-pharma relationship, Ali emphasizes. “This is because there is a value gap between what we find on the table and what we want to pay for". In simple terms, this means that payers often find that pharma companies want too high a price for a particular treatment and the “price does not represent good value to the patient” or the payer. “The value gap is always between the reimbursement price and what we think the product is worth.”

However, the interpretation of what brings added value may differ radically between pharma company and payer. One way that pharma attempts to add value is through additional services such as a patient-support program, toolkit, or by providing a nurse. Unfortunately, such services don’t always succeed in bridging the value gap; from the payers’ perspective many of them “don’t particularly resonate”, Ali suggests.

Indeed, some supposedly educational programs look suspiciously like promotion. “People have gone off a company just providing a nurse; we’re looking for a slightly more novel discussion.

“Value-added services have got to bring value,” he stresses. Fruitful areas for discussion might include innovative contracts, the incorporation of real-world data, commissioning through evaluation, and risk-sharing models such as pay-per-performance, whereby the company is reimbursed for achieving a certain goal. Examples of areas where this has worked well include treatments for cancer, rheumatoid arthritis and in relation to certain neurological disorders.

Part of the solution would be for payers to have a commercial discussion with the pharma company representatives yet most levels of pharma personnel are not usually authorized to have one. Although some pharma companies are having such discussions nationally with NICE or the Department of Health, CCGs (almost 220 of them) are also looking to have their own conversations locally, says Ali.

Commissioning through evaluation is one approach that is looking particularly promising, he reveals. “NICE have started this and also one or two local organizations.” The pharma company involved gains traction by having real-world data in a bubble – within a single “health economy” – which it can then potentially take to other CCGs.

Genuine innovation

So-called innovation is a particular bugbear with Ali. He questions what pharma organizations mean by “innovative”, stating: “We’ve lost the meaning of the word. When we see ‘innovation’ we are looking for a game-changer, a disrupter.”

Making a direct comparison between the release of new generations of Apple product and drug releases, he also questions whether health organizations should necessarily pay for innovation. “You need to innovate to stay in the market,” he says. Indeed he concludes with a telling quote from Professor Ron Adner: “Innovation is a problem for everyone...because it is held up as the solution for everything".

Omar Ali will be presenting at Value Added Services Conference, 17-18 September, London. For more information on his presentation, click here.