Innovation is Paramount: Choose to Outsource, Not Ignore R&D

AstraZeneca’s latest drug discovery partnership in China demonstrates the value of an early and innovative outsourced R&D effort in emerging markets.

The UK’s second biggest drug manufacturer will work with Chinese research company Pharmaronwho will provide a variety of drug metabolism, pharmacokinetics, chemistry and efficacy screening services to support AstraZeneca’s current innovative medicine units. Together, they will look for treatments in the respiratory, cardiovascular, infectious, cancer and gastrointestinal disease areas. As a result of the partnership, a number of Pharmaron scientists will be added to AstraZeneca’s existing project team at its drug discovery centre in Shanghai.

A recent Just Health consultation with ten pharmaceutical companies like Janssen, Caris Lifesciences and Shire Pharmaceuticals highlighted that drugs are being launched in emerging before traditional markets of US and Europe as innovation and growth in the latter might be slower. This consultation is supported by figures demonstrating that the Chinese prescription drug market which has already taken more than $50 billion this year, is due to become the world’s third–largest pharmaceutical market by 2013.

Additionally, global consultancy firm McKinsey and Company predict that the Chinese consumer healthcare market could reach $60 billion by 2020. Thus, China’s emerging drug markets can offer new manufacturing and research opportunities to sustain the pharmaceutical industry in the future.

These projections will be nothing new to AstraZeneca who cut back on in-house R&D in 2006 but then proceeded to make a $100 billion R&D investment in Shanghai by building the AstraZeneca Innovation Centre in China. Initially, the centre focused its drug discovery efforts on China but now concentrates on diseases in Asia.

Steve Yang, Vice President and head of R&D for Asia and the emerging markets stated that AstraZeneca’s heavy investment in China will give them access to China’s scientific resources as well as other external partners in Asia, which is a source of support that the other pharmaceutical companies currently lack. As a result of sustained R&D efforts in China, they have already built up a lot of useful data, contributed to global oncology research in the biomarkers area as well as building a good reputation locally.

For example, AstraZeneca has built on its R&D efforts in China by focusing relevant disease areas like gastric and liver cancers which is more prevalent in Asia than the other western countries. Big Pharma does not always think about adapting their business model to these emerging markets and so AstraZeneca has already put itself in a better position than some of the other pharmaceutical companies.

But, Yang still maintains that they have a long way to go as he states that "it takes 10 to 15 years to take an idea all the way from a scientist's hypothesis to products on the market." His view shows the importance of making an early R&D start in an emerging market like China for the long-term although not current success of AstraZeneca.

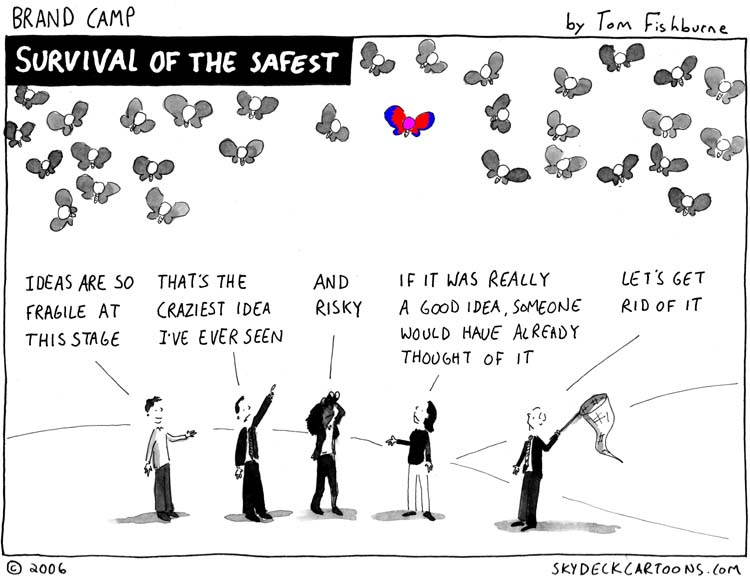

In recent years, a downturn in R&D has resulted in a weak pipeline for the pharmaceutical industry, and there has not been a major focus on sustained innovation due to the past dependence on blockbuster drugs. But, as their partnerships in China continue grow, AstraZeneca has shown that their risk to invest early in a new R&D market is starting to pay off. If more individuals within the pharmaceutical industry was to follow their example and not be afraid to take some risks occasionally, progress and innovation would not currently be stagnant.

Image courtesy of Tom Fishburne, click to enlarge