eyeforpharma Philadelphia 2014

Make customer centricity work: smart pharma mindsets, models and technology that will seal commercial success

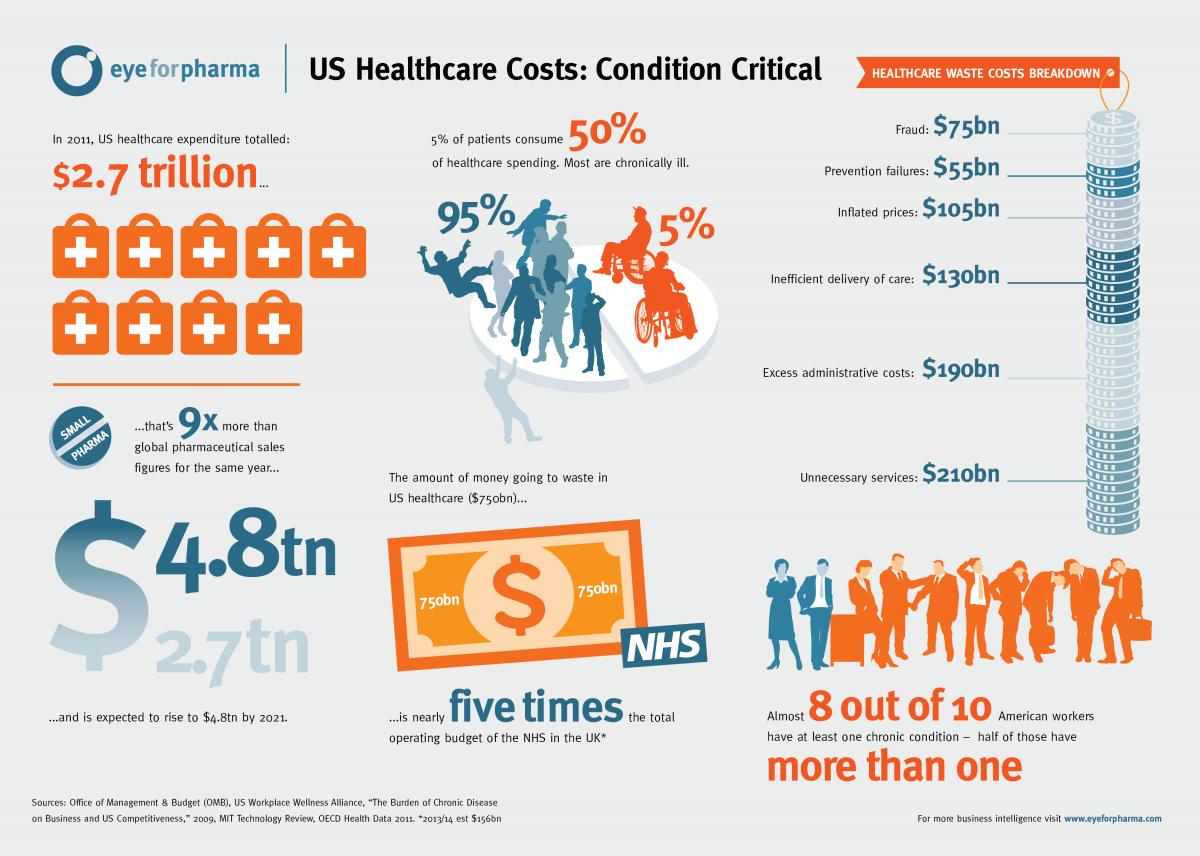

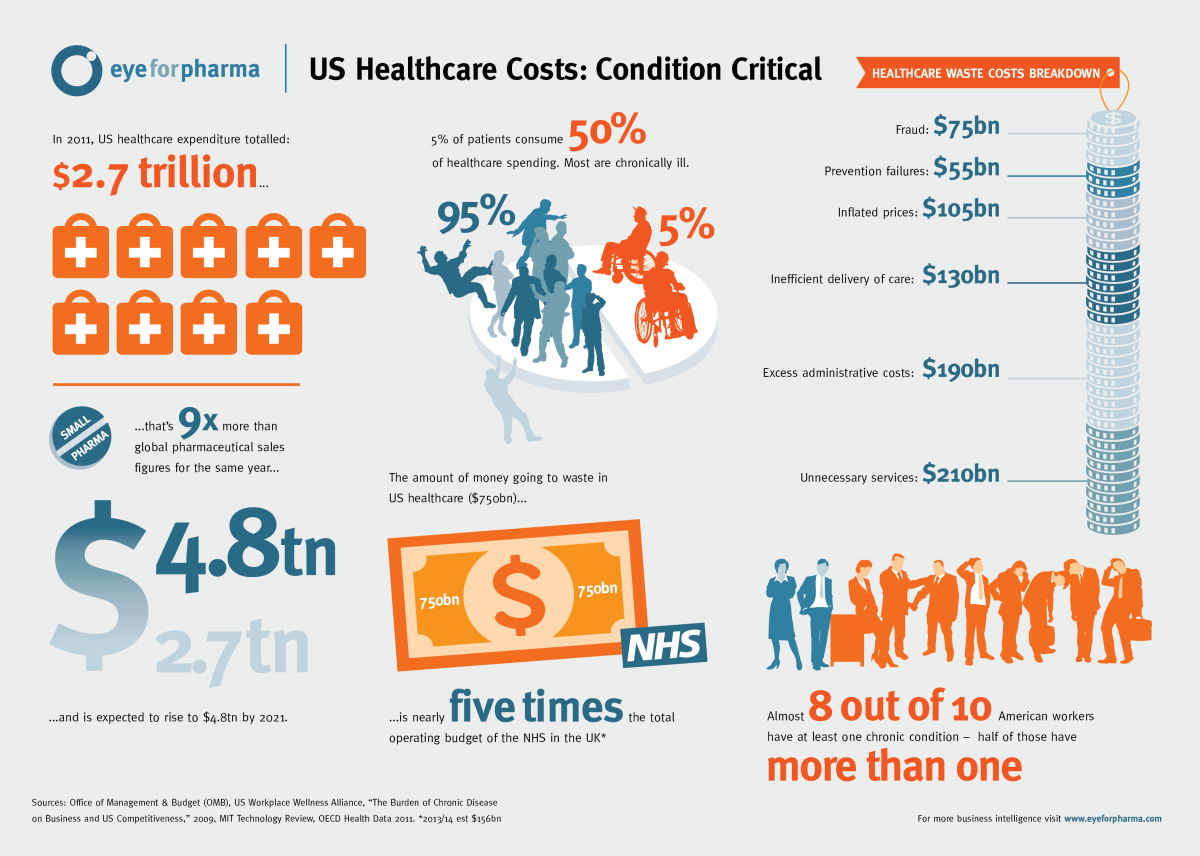

The Cost Conundrum: Pharma’s Role in US Healthcare (Infographic)

According to many, the single biggest threat to the fiscal health of the United States is the skyrocketing cost of healthcare. Deirdre Coleman investigates the real cost of healthcare, the implications for pharma and the role pharma plays in moving towards a more cost-effective health system.

The United States spends far more on healthcare than other wealthy countries. McKinsey’s 2011 report, Accounting for the Cost of US Healthcare, found that even when healthcare expenditures were adjusted to reflect national wealth levels, the United States outspends other developed countries by $572 billion annually. For the most part, US higher healthcare spending does not deliver demonstrably better outcomes.

Furthermore, growth in per-person US healthcare spending (medical cost inflation) is increasing at a substantially higher rate than general cost inflation. Currently running at 18% of GDP, US health care spending reached $2.7 trillion in 2011, or $8,700 per person, according to OECD Health Data, 2011. Spending is expected to nearly double to a staggering $4.8 billion in 2021.

The exorbitant cost of healthcare is unsustainable and the net results of rising health care costs are ominous: higher costs for health insurance, an erosion of US global competiveness, and long-term fiscal insolvency.

Impact of Healthcare Reform

The Affordable Care Act contains a number of provisions to slow the growth of health care spending. Healthcare reform and industry trends are driving pharma companies to rethink strategy, firmly placing cost-effectiveness at the top of their corporate agenda.

As the US health care system transforms from fragmented care to fully integrated systems of care, and from rewarding volume to rewarding efficiency and quality outcomes, all stakeholders are accountable for achieving high performance and patient-centered goals. Over the next few years, collaboration will be integral to defining health care organizations and how they interact within, and beyond, their walls. Silos must be razed; partnerships built; shared purposes forged. (cont...)

(click to enlarge)

Proof of Value: A Moving Target

The biopharmaceutical industry today is facing a multifaceted “value challenge.” It is no longer enough for pharma companies to create products that are simply safe and effective: they must also develop medications which provide results that are superior to those already on the market. At the same time, companies have to demonstrate this added value to a range of stakeholders if they wish to command prices that are higher than those of existing treatments. These tasks are further complicated by a shift in the balance of power among industry stakeholders, each of which may require different evidence to be convinced of a product’s value. Previously, doctors might have been satisfied with even marginal improvements in efficiency at any price; today, increasingly influential healthcare payers are no longer so easily convinced.

According to Mohit Kaushal, Partner at Aberdare Ventures, the criteria for purchasing has changed irrevocably and just demonstrating improved quality is not enough – pharma must demonstrate cost-effectiveness: “Soaring healthcare costs and the move towards “bending the curve” on healthcare costs is driving everything, decision-wise in the healthcare market. In my opinion, one major trend affecting the biopharmaceutical and medical device industry will be erosion in premium pricing for many disease franchises. In the pre-reform world, device and drug products would be priced at a premium based just on improvements in quality. Even marginal improvements could often command a price premium. Now, as risk gets shifted to provider systems, the need to show cost-effectiveness of products becomes a core requirement in order to get paid for and adopted. As risks get shifted to consumers; that also will drive more cost-effective purchasing decisions.”

Driving Efficiencies

Pharmaceutical companies have a key role to play in the movement towards driving down the cost of healthcare.

“Driving down the cost of healthcare is in everyone’s interest and is everyone’s problem. Medication non-adherence and delayed evidence-based treatment practice are key contributors to avoidable costs. Non-adherence costs the economy $289 billion. In some 20 percent of cases - and as many as 30 percent - prescriptions for medication are never filled. Up to 50 percent of medications aren't taken as prescribed. Screening and diagnostic capabilities could support timely medicine use for highly prevalent diseases and ensure that patients receive medicines to prevent or delay relatively costlier complications. Other examples of avoidable costs are the huge cost of drug discovery development and the protracted process of clinical trials due to inefficiencies in the process. Encouraging progress is being made in addressing some of the challenges that drive wasteful spending in many parts of the healthcare system. Such improvements are possible only through collaboration among multiple healthcare stakeholders. Healthcare informatics — the use of technology and analytical approaches to harness the value of data — is a key driver of improvements."

"Pharma companies will need to uncover efficiencies and become partners in the process of driving down the cost of healthcare. When companies like Starbucks are spending more on healthcare than on coffee beans it emphasizes the severity of the situation. It becomes an issue of international competiveness. It affects everyone and everyone has a part to play in fixing this crisis. Healthcare’s hyperinflation is driving the transformation of how care gets reimbursed resulting in a massive disruption in healthcare. A collective approach to reducing healthcare costs is imperative and this necessitates collaboration between payers, providers, pharma, patients, pharmacists, policymakers and employers”, concludes Kaushal.

It’s time for a fundamentally new strategy. At its core is maximizing value for patients: that is, achieving the best outcomes at the lowest cost. The transformation to value-based health care is well under way. The question is, which organizations will lead the way and how quickly can others follow?

eyeforpharma Philadelphia 2014

Make customer centricity work: smart pharma mindsets, models and technology that will seal commercial success